Biohit Oyj is Finnish biotech company founded in 1988 and publically listed in Helsinki Stock Exchange since 1999.

After selling their pipette business in 2011 they decided to concentrate fully to their diagnostic business. At its core is GastroPanel – unique panel of blood test used for analyzing stomach health. It can be used to to pick out the patients in need for gastroscopy and in stomach cancer screening.

Gastropanel had failed to gain any significant use in health care in Finland or elsewhere in the world but all changed in 2015. It was the year when China started a large gastric cancer screening study and decided to use Gastopanel for it. [1] [2]

Use of Gastropanel in China is particularly useful because the country has a huge epidemic of gastric cancer. On average over 1000 people are diagnosed with gastric cancer – every single day! Also the country lacks personnel and resources to do the needed amounts of gastroscopies. Use of Gastropanel therefore would save lives and medical resources.

As the study started there already was a factory being built with Biohit Oyj’s Chinese joint venture partner: Biohit Healthcare Hefei Co.Ltd

This factory had a annual capacity of 7,4 million Gastropanel tests. The price for a Gastropanel in China is around 30 euros per test. These figures promised huge rewards for Biohit shareholders.

The project was massive. There was typically several hospitals starting Gastropanel screening projects every week.

Biohit shareholders were naturally investing heavily in the company at the time. As Biohit was not making any profit at the time but losses around 1-2 million per year, it was naturally presumed the GP study and the use of GP in the country outside of the screening project would make the company profitable.

In October 2016 the Chinese GP factory was finally ready to start sales and the GP study had been further expanded to cover 150 hospitals. [3]

Around this time Biohit Oyj would start reporting its results only every 6 months as this was recently made possible by stock exhange regulations.

In January 2017 the joint venture with the Chinese Biohit Hefei company was dismantled and Biohit Oyj received only 1,8 million euro in cash for their 40% stake in company. This low value again raised some eyebrows, but it was communicated to public that Biohit Oyj would receive similar profits as with the joint venture and “license and distribution agreement remains in force for at least 15 years”. [4]

The reported profit in 2017 was only “paper profit” and transitory due to joint venture dismatling. GP studies in China were not as profitable as assumed. The company was still losing money and barely making anything in China. This raised the first questions among shareholders.

In December 2017 Chinese health authorities announced new draft of gastric cancer screening guidelines. It included Gastropanel biomarkers.

In January 2018 it was discovered by active shareholders that Biohit Healthcare Hefei was planning to construct a new factory just little over one year after the first one was ready. It had possibility to manufacture 10 times the capacity as the first factory: 75 million Gastropanel tests. It was planned to be completed in December 2018, in less than year!

Next day Biohit Oyj had to issue a press release. [5]

Biohit shares exploded and there was a sense of joy and contentment among the owners of Biohit Oyj. All of their hopes and dreams were about to be made true. Altough the way the news was made public caused astonishment in shareholders. Why isn’t their important Chinese partner telling them they are building yet another factory?

In Februay 2018 Biohit Oyj reported lousy results as usual. These were brushed quickly side by the shareholders because in the future things were about to change.

Nowadays every insider stock trade have to be reported by a press release. As the stock settlement time is two days, all insider stock trades get reported two days later.

The poor result caused the usual decline in Biohit Oyj’s share price but two days later something extraordinary happened. A press release was issued telling Biohit’s CEO Semi Korpela sold most of his shares even when the company was just on the verge of a huge breakthrough. [6] Biohit’s sales and marketing director Ilari Patrakka also sold a huge portition of his shares. [7]

As it’s one of the stockmarkets oldest guidelines to “buy when management buys and sell when the management sells” this news caused a flash crash in Biohit’s share price, taking it down to lowest level in six years.

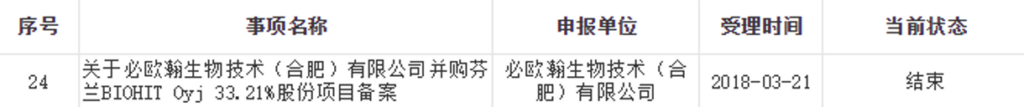

There was lot of speculation among shareholders “they must know something” or the “truth” about matters. To make things even more crazy, active shareholders found out again before official news that Biohit’s founder and head of board Osmo Suovaniemi is going to sell 29,5% voting rights based on shares and 33,2% of total number of shares to Biohit Healthcare Hefei in April of 2018:

The price was a low of 4,26€ per share. Biohit Oyj was forced to issue a press release the following day. [8]

Speculation was rampant of the causes. As he was 74 years old at the time it could be argued he was getting ready to retire.

In next August management not only continued to dump their shares but they also sold their stock option subscription rights that were worth less than half than the share price at the time! [9-1] [9-2] [9-3]

After these events the share price remained permanently subdued. Things seemed to progress at slow speed. Profits from China actually started to decline. The factory completion date was postponed to end of Q1 2019. Continuing Biohit’s tradition of terrible communication habits to shareholders, few weeks before the supposed completion it was postponed again to end of 2019, later on to Q1 2020 and finally to late 2020. After this Biohit Oyj has never mentioned the new factory again. It was again the shareholders that had found out themselves the factory was completed little over two years late in early 2021.

In April 2021 all hell broke loose. Largest daily newspaper in Finland Helsingin Sanomat published a multi-page scandal story in a Saturday issue where it was revealed the company had drifted into a crisis with its business in China. In it Biohit Hefei CEO Liu Feng revealed that he will demand Osmo Suovaniemi to step down as the leader of the board in next shareholder meeting. Among his critique was that “Osmo is too old”. [10]

Biohit, a listed company in the diagnostics industry, and its founder Osmo Suovaniemi tell investors a story about the possibilities of Finnish inventions in China. In reality, Biohit is in crisis and Chinese capital is driving Suovaniemi’s resignation.

Biohit shares again tanked the following Monday and company commented the claims made in the story. [11]

Few weeks later CEO Semi Korpela was fired from his position and Biohit started a breach of the patent license case Arbitration Institute of the Finland Chamber of Commerce in May 2021. The goal of the arbitration was to prevent a legal proceedings and court case. [12]

It is my suspicion that Semi Korpela and Ilari Patrakka knew or suspected the Chinese were cheating the company for the whole time and decided to save themselves and their bank accounts!

No wonder there wasn’t any meaningful profits coming from China because they were cheating for the whole time as growing number of shareholders had already suspected!

The lack of morals in both the Chinese and Biohit’s past executive team has lost shareholders huge amounts of money. Whole life savings and lives were ruined. I personally lost 70% of my investment and years later I’m still trying to make ends meet and recoup my money but in the current stock market it’s very difficult.

For several years already, Biohit Hefei(Biouhan) has been hailed in the Chinese media as the “next unicorn company”. Unicorn company means a company with a market value of over one billion dollars.

Biohit Finland has a market value around of meager 25 million.

In February 2022 Biohit and Biouhan(it’s new name) reached a settlement and resulting the Chinese to pay more license fees to Biohit. [13].

During the following summer Biohit Oyj’s share price dropped to little over 1.00€. It had peaked over 6 euros after the GP screening and factory news.

In August of 2022 Biohit Oyj issued the first positive profit warning since selling their pipette business. [14]

The stock rebounded to little over 2.00€ but soon started to decline again. Investors are vary and cautious because as the old proverb goes:

“Fool me once, shame on you; fool me twice, shame on me“

What I learned from this?

1.The Chinese can’t ever be trusted, even though you have a deal made and your end-user is the Chinese health authorities.

2.Stock company executives will usually always think their own bank accounts first, then the rest. Any wrongdoing is hard or even impossible to prove.